What business intelligence contributes to financial management

WHAT BUSINESS INTELLIGENCE CONTRIBUTES TO FINANCIAL MANAGEMENT

The intelligence business is considered as an element for large enterprises, since one does not usually advanced technology be accommodated within an SME. However, a financial analysis goes beyond the information that is collected, and its interpretation can affect strategic decisions, so this tool is essential for the management of any company, regardless of its size.

Specifically, business intelligence helps to interpret the data extracted from different sources, adding value and dynamism to the financial department. Precisely, according to Michael Page, another of the main reasons for implementing BI in an organization is that thanks to it, the analysis and interpretation of data from the CFO supposes a significant dose of confidence on the part of the senior management team .

Next we will discover what business intelligence is, what it contributes to the financial area of an organization and the three main advantages that its implementation brings to a company when making decisions.

What is business intelligence?

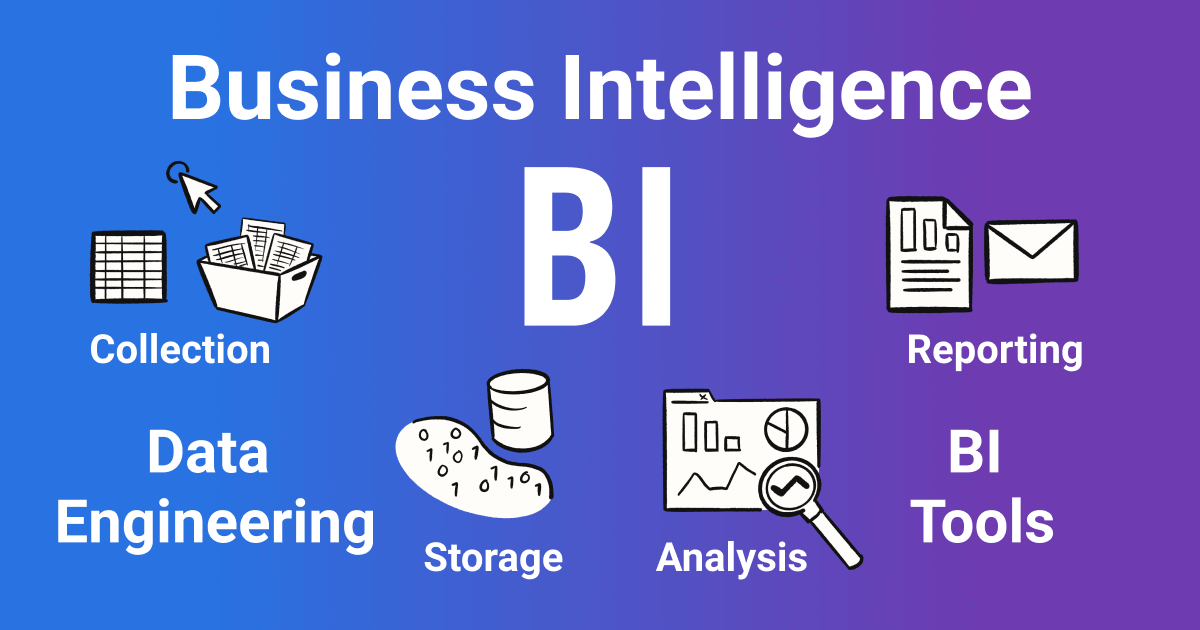

The term business intelligence refers to the transformation of business data from information to knowledge through different strategies and tools, with the aim of improving the decision-making process in a company.

Today, thanks to big data, the amount of data obtained by any company can be so massive that analyzing and interpreting it to make the right decisions is one of the main differentiating factors. For its part, business intelligence is nothing more than a methodology by which knowledge based on trends is obtained after collecting data from the different management systems.

Business intelligence tools, an advance for the financial area

Data processing in companies has always been subject to very limited possibilities, but in particular, the financial area is the department with the greatest limitations in terms of access to data and information sources. And it is that, before the arrival of technology to the area of finance, they only focused on ratios and general indicators measured through internal sources that always followed the same pattern.

The business intelligence and business analytics have been a huge advance on this issue, since they allow processing data of an organization incorporating external sources that increase information and subsequently the structure for analysis and presentation of reports, dashboards and panels that show them clearly and precisely.

Therefore, the information that is given by all these data is transformed into knowledge through the dynamic presentation of the same, and thus, it is possible to improve decision-making and optimize the economic-financial strategies of a company. Moreover, the direction of this department is benefiting from the b ig finance data for being able to predict in advance the consequences or effects of changes based on the information.

Just as traditional analysis tools analyze and compare current and historical data for KPIs and key indicators, big data and business intelligence tools go further and forecast future behavior. In this way, and thanks to both variables, it is possible to predict the financial behavior of the company in the next period.

The 3 main advantages of business intelligence in finance

The advantages that a financial department obtains when making use of business intelligence tools are many, such as:

- Business intelligence helps answer different questions based on real information. The data that the tool works with is collected and displayed instantly, offering 100% accurate information.

- Access to data is made on demand, that is, business intelligence and business analytics allow combining different pieces of information and contrasting various graphs depending on the needs of each user to obtain knowledge that is required to make each decision.

- .Business intelligence makes it possible to represent the main financial KPIs, such as risk levels, data trends, financial flows or the monitoring of profits and expenses, in a simple and visual way, helping to make decisions based on the facts.

In short, business intelligence is one of the best drivers of efficiency in any department and also in the financial one, not only because of its usefulness and its precision in real time, but also because it is a fundamental piece in strategic decision-making.