| Introduction to Tesla and its Stock Performance |

|

Tesla, Inc., an American electric vehicle and clean energy company, is known for its innovative products and technologies. Its stock performance has been closely watched by investors and analysts. |

| History and Background of Tesla |

|

Tesla was founded in 2003 by Martin Eberhard and Marc Tarpenning. Elon Musk joined the company in 2004 and became its CEO and product architect. Tesla went public in 2010. |

|

Early Challenges and Successes |

In its early years, Tesla faced numerous challenges, including production delays and financial difficulties. However, the company gained traction with the success of its Model S sedan. |

| Factors Influencing Tesla’s Stock Price |

|

Several factors influence Tesla’s stock price, including demand for electric vehicles, competition in the market, regulatory environment, and macroeconomic conditions. |

|

Electric Vehicle Market Growth |

The global demand for electric vehicles is expected to rise significantly in the coming years, which could benefit Tesla’s stock price. |

|

Competition in the Electric Vehicle Market |

Tesla faces competition from both traditional automakers and new entrants in the electric vehicle market. |

|

Regulatory Environment |

Government regulations and policies related to electric vehicles and clean energy can impact Tesla’s stock performance. |

| Elon Musk’s Influence on Tesla’s Stock |

|

Elon Musk, Tesla’s CEO, is known for his unconventional approach and active presence on social media. His tweets and public statements often impact Tesla’s stock price. |

|

Market Sentiment and Investor Confidence |

Investor confidence in Tesla is influenced by Musk’s leadership and vision for the company. |

| Tesla’s Innovation and Market Position |

|

Tesla is known for its innovative products, including electric vehicles, solar energy products, and energy storage solutions. Its strong market position has contributed to its stock performance. |

|

Energy Storage Solutions |

Tesla’s energy storage products, such as the Powerwall and Powerpack, are in high demand for residential and commercial applications. |

| Financial Performance and Stock Analysis |

|

Tesla’s financial performance, including revenue growth, profitability, and cash flow, is closely monitored by investors. Stock analysts often provide recommendations and price targets based on Tesla’s financial metrics. |

|

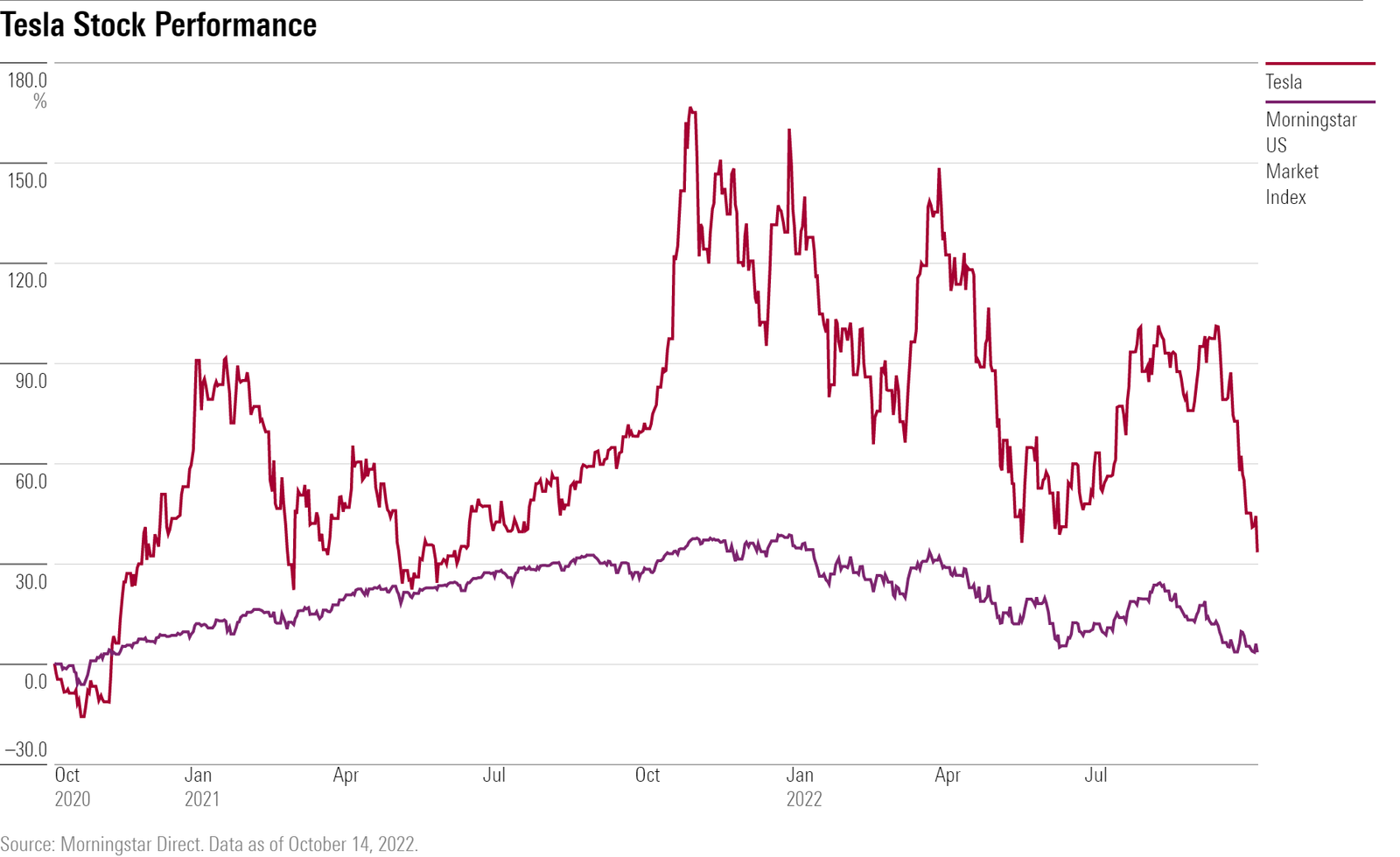

Stock Valuation and Price Volatility |

Tesla’s stock valuation has been a subject of debate, with some analysts considering it overvalued due to its high price-to-earnings ratio and price volatility. |

| Recent Developments and Future Outlook |

|

Recent developments, such as new product launches and expansion into new markets, can impact Tesla’s stock price. The company’s future outlook depends on its ability to innovate and maintain its competitive edge. |

|

Expansion into New Markets |

Tesla’s expansion into markets like China and Europe has been a key driver of its growth and stock performance. |

| Risks Associated with Investing in Tesla |

|

Investing in Tesla carries risks, including market volatility, regulatory risks, competition, and potential production challenges. Investors should carefully consider these risks before investing in Tesla’s stock. |

|

Environmental and Social Risks |

Tesla’s reputation and stock price could be affected by environmental and social issues, such as environmental regulations and labor practices. |

| Conclusion |

|

Tesla’s stock performance is influenced by a variety of factors, including market demand, competition, regulatory environment, and the leadership of Elon Musk. Investors should carefully evaluate these factors before investing in Tesla’s stock. |

| FAQs |

|

|

|

1. Is Tesla a good investment? |

The answer to this question depends on individual investment goals and risk tolerance. Tesla has potential for growth but also carries risks. |

|

2. What is the future outlook for Tesla? |

Tesla’s future outlook depends on its ability to innovate, compete, and meet market demand for electric vehicles and clean energy solutions. |

|

3. How does Elon Musk influence Tesla’s stock price? |

Elon Musk’s public statements and actions can impact Tesla’s stock price, as investors closely follow his leadership and vision for the company. |

|

4. What are the main risks of investing in Tesla? |

Risks associated with investing in Tesla include market volatility, regulatory risks, competition, and potential production challenges. |

|

5. How does Tesla’s stock performance compare to its competitors? |

Tesla’s stock performance is often compared to other automakers and clean energy companies, with its innovative products and market position being key factors in the comparison. |