Payment gateway: what is it and how to choose yours

In order to sell online, you need to know what a payment gateway is and how to choose the one that best suits you and your ecommerce. It is a must. Because it is of little use that you have the best products, that you are in the top 10 of Google or that your publications on social networks are very successful. Without a proper payment gateway, your potential buyers can turn around. So take note.

The e – commerce is no longer something reserved for a handful of large technology companies. The small and medium enterprises begin to see its potential and bet on eCommerce platforms to market their products available to a larger number of consumers. However, many people are still unaware of the basics of the online sales process. One of them is the importance of choosing a good payment gateway .

What is a payment gateway?

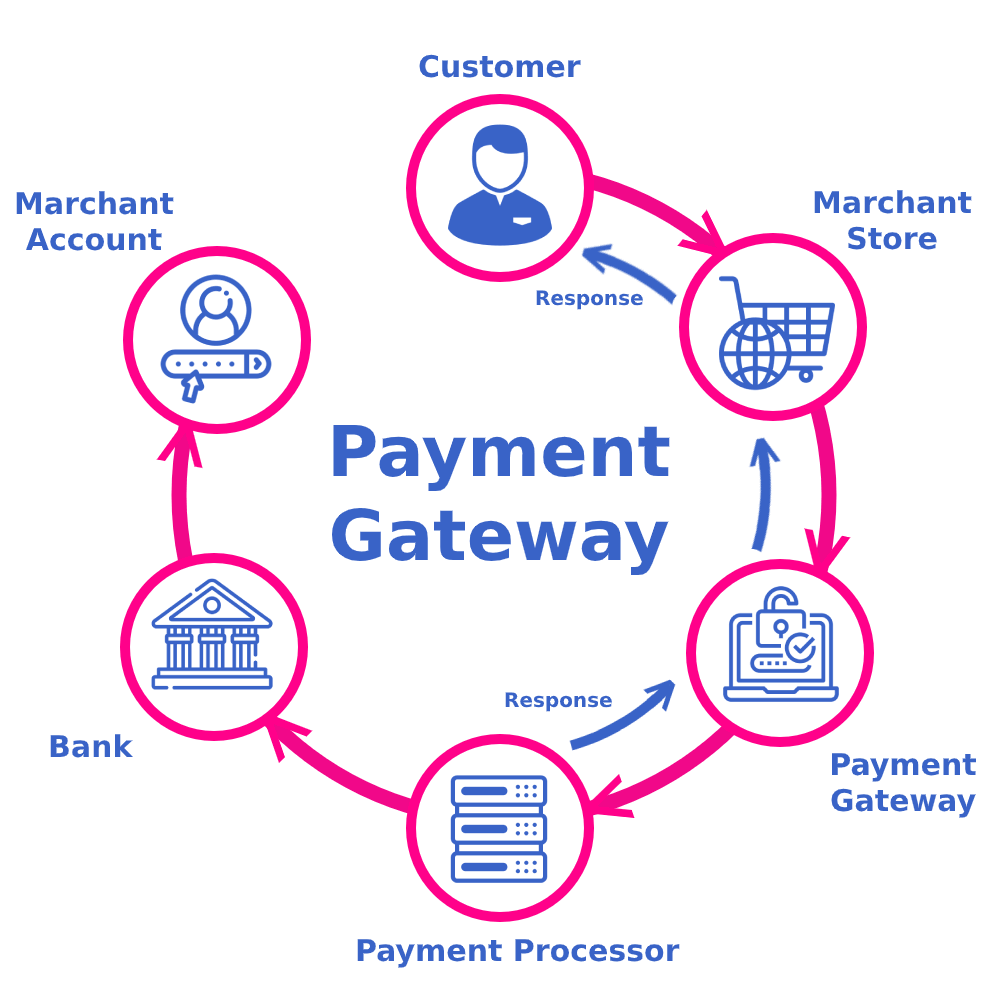

A payment gateway is a tool integrated in electronic stores to authorize and pay for products. This service is essential to guarantee the security of transactions and, at the same time, speed up and facilitate the user experience. In other words, a payment gateway allows:

- Make a payment correctly and safely.

- Facilitate the shopping experience for customers.

Imagine that you want to buy a t-shirt in an online store. You choose the model you like and add it to the cart. When you have your purchase decided, you will process your order. You complete your information at checkout and, at the end, a new page opens for you to type the holder and number of your card. That’s the payment gateway !

- If you are an online commerce user , you should know that this gateway is the one that facilitates the encryption of your data and communication between online commerce and your bank.

- If you are a seller , you also have to bear in mind that this service is essential and that there is no single provider . It is also common for many novice merchants to assume that a website or certain CMS adds this payment functionality by default (although this option exists in some cases, it is not usual).

This payment gateway is, in short, a mediator service between the natural person who makes the payment (specifically, their bank account) and the company that receives it. Through it, the payment is managed safely and the safety of whoever makes the purchase is guaranteed.

How to choose a payment gateway?

Let’s imagine now that you have decided to jump into the digital world and open an online store. You have already completed the ‘checklist’ of your website and you need to incorporate a payment service, what should you do now? What are your chances?

Although there is a long way to go, there are more and more options available to choose a payment gateway that suits the requirements of your online store. However, you should keep a few things in mind before choosing:

- Check that the payment gateway can be integrated into your CMS , on your website.

- Make sure the chosen gateway accepts payments through mobile systems . The consumption of articles through the mobile phone is, today, the main form of online purchase.

- Check the cost and commissions of each payment gateway. It is important that you have a perspective or expectation of the volume of business that you can receive. Especially important is that you know, at least, the average spend per customer that you expect to receive. So you can calculate the profitability of using one option or another.

In addition to these three basic tips, there is something you should always keep in mind: ensure the security of both your platform and consumer information. Jordi Nebot, CEO and Co-founder of PaynoPain offers some security keys in this interview in Cinco Días :

“Make sure it is a secure server that complies with current regulations. Choose restricted payment gateways or check their security protocols. When looking for a payment provider, it is essential that they have the PCI DSS certification and have the necessary technology to comply with the European PSD2 regulation. Also, it is important that the provider has authorization from the Bank of Spain to operate in Europe. The main key when choosing a secure payment gateway is that it allows 3D Secure authentications, which require two steps to confirm online transactions. “

Most popular payment gateways

Some of the most popular payment gateways are:

- PayPal . Without a doubt, one of the most used platforms. It is one of the great references in the market, operating since the late 90s, and among its founders are well-known names such as Elon Musk.

- Stripe . It is the payment gateway with the highest growth and development in recent years. One of its great advantages is a very competitive price : in Spain it charges 1.4% of the transaction + 0.25 euros per transaction if the credit card is European, without a monthly minimum. Compared with PayPal or with a classic POS in a physical store, the commissions are lower.

- Redsys . It is one of the most widespread gateways among companies with tax headquarters in Spain. Its main advantage is that it operates with most of the national banks and is well established in our country.

Although these are some of the most used payment gateways, there are other options. If you are curious or none of the above convinces you for whatever reason, do not hesitate to ask Google.

The article Payment gateway: what is it and how to choose yours was written on March 4, 2021 and saved under the category Tips for digital life . You can find the post in which we talk about All ecommerce needs to process payments online, the choice of one gateway or another will depend on several factors. Which one do you need? under the following tags