The differences between Payment Gateway and Payment Processor

A payment gateway and a payment processor are two of the essential actors in the online payment process. As an online store owner, you have most likely heard these concepts before, but what is the difference between a payment gateway and a payment processor?

The main difference is that a payment gateway captures and sends the bank information of the purchaser to the processor. In addition, it communicates the status of the transaction (accepted or denied ) to you and the buyer.

The payment processor transmits the information between the customer, the issuing bank, the acquiring bank and the store. All this happens in the background, takes a few milliseconds and ends when the money reaches your bank account (if the payment has been authorized).

In this article, you will discover the differences between these two fundamental concepts, how they are completed and how to choose the best provider for your online store.

What is the difference between a payment gateway and a payment processor?

To understand the difference between a payment gateway and a payment processor, we must first analyze the terminology used in the sector and how payments work, both in physical stores and online:

Payment gateway

- A payment gateway is a type of payment service provider (PSP) that encrypts and transmits payment data to the payment processor once the transaction has been initiated. It also notifies you and your client if a transaction has been approved or denied.

- A payment gateway is essentially used to accept more payment methods in online stores, but its technology also allows you to receive payments with card readers, mobile payment applications , and POS (Point of Sale Terminals).

payment processor

- Payment processors transmit transaction data between the customer’s issuing bank and the seller’s acquiring bank .

- A payment processor is necessary to process all card transactions, be it face-to-face sales, by mobile application or online.

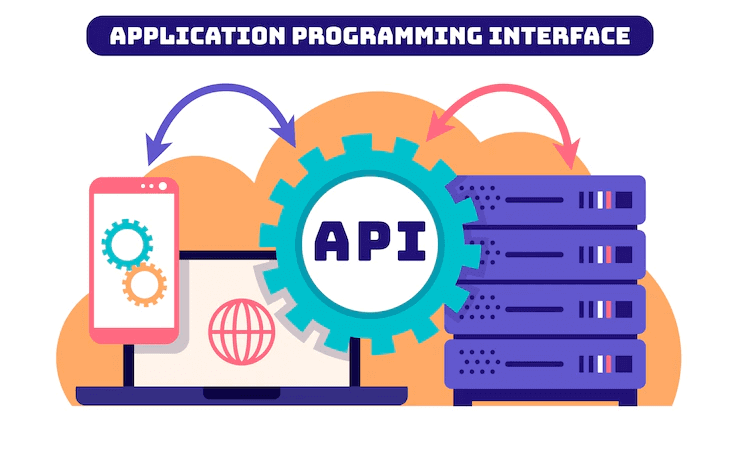

Here is an illustration to visualize the process of online payments, with the role of the gateway and the payment processor:

You already know the basics, but to better understand the differences between a gateway and a payment processor and how they work, keep reading about terminology:

Online payment terminology

Familiarize yourself with the terminology used in payment processing. These are the main terms you should know.

- Client . the cardholder who pays for products or services. The customer enters the credit card details and initiates the transaction.

- issuing bank . the bank that provides the customer with his credit card.

- Trader . the company that sells products or services, whether on the street or digitally.

- Virtual POS . Specific payment terminal for online businesses. It allows you to complete purchases with credit and debit cards, and other forms of digital payment. With the right payment service provider, accepting card payments without virtual POS is possible.

- acquiring bank . the bank that hosts the merchant’s credit card processing account.

Payment Processor . the service that sends transaction information between the merchant, the issuing bank and the acquiring bank. - Point of sale . a credit card processing machine at a physical location that reads EMV chips on credit cards and sends them through the payment processor.

- EMV chips . this electronic chip is part of smart cards. EMV stands for Europay, Mastercard and Visa, which were the original three processing companies that agreed to implement these chips in their cards. An EMV chip card generates a one-time transaction code that helps prevent fraud when a card is used at a point of sale.

- Payment gateway . the equivalent of a point of sale system for online transactions, it encrypts and transmits the information to the payment processor. A payment gateway provides integrations into different e-commerce platforms and APIs to make transactions. It also receives authorization for banks to transfer money from the customer to the seller.

- Payment tokenization . the process of converting the customer’s card to another number to secure their private information for online shopping.

Related article: What is Tokenization? What are its benefits for e-commerce?

What is a payment gateway?

A payment gateway is the equivalent of a credit card terminal, but specifically for digital transactions. Without a card physically present, the payment gateway has to authenticate the card without the help of an EMV chip. The gateway also encrypts the customer’s banking information to keep it secure.

How does a payment gateway work?

When a customer pays at an online store, they enter their payment information on the checkout screen. This is where it is necessary to have the payment gateway. Payment gateways are usually easily integrated into different eCommerce platforms, with simple APIs/SDKs , if you want custom integration into your own system. The gateway encrypts the data and sends it to the acquiring bank’s payment processor.

The acquiring bank sends the payment request to the issuing bank through the payment processor, and the issuing bank approves or denies it. If the transaction is approved, the payment gateway transmits the approval to the customer and closes the sale. If the bank requires 3D Secure authorization , the payment gateway will display a confirmation screen to the customer

What is a payment processor?

A payment processor is necessary for sales both online and in physical stores.

For payments in person, a payment processor relays the information between the merchant, the issuing bank, and the acquiring bank. The processor provides the store with a point of sale or payment terminal. Payment terminals must be able to read EMV chip cards.

For digital transactions, there is also a payment processor, but it works with a payment gateway instead of a physical payment terminal. The payment processor performs the transaction once the data has passed through the gateway.

How does a payment processor work?

When a customer uses their card in person at the payment terminal, the terminal authenticates the card and sends payment information to the issuing bank. The issuing bank approves or rejects the transaction.

The payment processor then transmits the approval or denial to the terminal. If the transaction is approved, the payment processor also sends the payment information to the acquiring bank.

For online transactions, the customer initiates the payment by entering their data through the payment gateway. The payment gateway encrypts the information, converts it into a token, and sends it through the processor. The processor transmits the approval or denial to the customer through the payment gateway. When the payment is approved, the processor transmits the payment information to the acquiring bank.

Do I need a payment gateway AND a payment processor?

To process online transactions, a payment gateway and processor are necessary. The payment gateway operates at the beginning and end of the transaction, where the customer enters their bank details and receives an approval or denial of the transaction. The payment processor moves information between the customer’s bank and the seller’s bank, or acquiring bank . Each transaction processed online needs both elements.

Is MONEI a payment gateway or a payment processor?

MONEI is a payment gateway with acquiring services included. This means you don’t have to work with an acquiring bank to get a virtual POS and process card payments. We offer you a platform that manages the acquisition for you. We work with multiple payment processors so you can set up payment routing rules with our payment orchestration functionality . In this way, you will be able to approve more payments and reduce the number of failed online payments , sending your transactions to more than one processor (in case one has temporary problems). Use MONEI to improve your payment flows, accept a wider range of alternative payment methods andlocal , and reach more customers internationally.

How to choose the best processor and the best payment gateway for your e-commerce?

Now that you know the basics about what goes on behind the scenes, consider what you need from a payment processor and payment gateway for your e-commerce. Depending on your present and future needs, the best option could be an “all-inclusive” PSP that offers you a multi-channel payment gateway, as well as processing services.

Consider the following factors:

- Is the PSP reliable and secure? Is it PCI compliant and does it offer 3DS authentication ?

- Does the PSP have flexible rates ? Dynamic fees are good for your business: the more you sell, the more you save on transaction fees.

- Is the PSP easy to integrate with your e-commerce platform or custom website?

- Does it allow you to accept online and face -to-face payments ?

- Does the PSP allow you to accept the most popular local payment methods?

📌 Tip: Choose a powerful and affordable payment solution for your business. Use a paphos gateway that works with multiple processors and banks, that integrates a maximum of payment methods and that allows you to accept card payments without virtual POS . And if you already have a virtual POS set up with your bank, you can opt for our MONEI PLUS plan .